How AI Will Transform Kakao Talk Biz: Can It Overcome the Crisis of Negative Growth?

Under the leadership of CEO Jeong Shin-a, who was appointed in March last year, Kakao has been restructuring its business around what it considers its core essence—KakaoTalk. The company is focusing its growth efforts on Talk Biz, particularly in ‘advertising’ and ‘commerce.’ Meanwhile, non-core businesses are undergoing efficiency improvements and resource allocation based on priority.

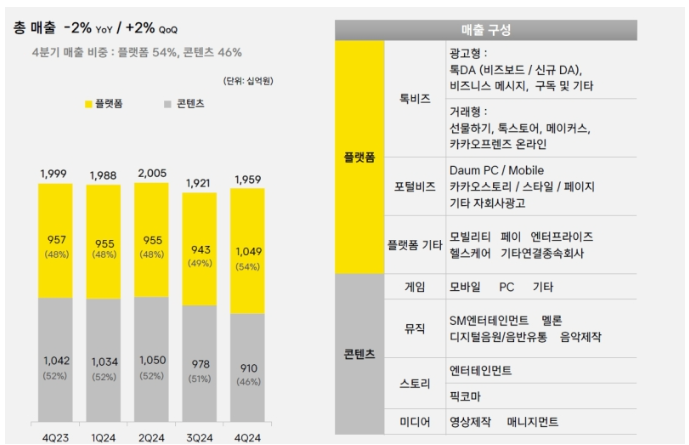

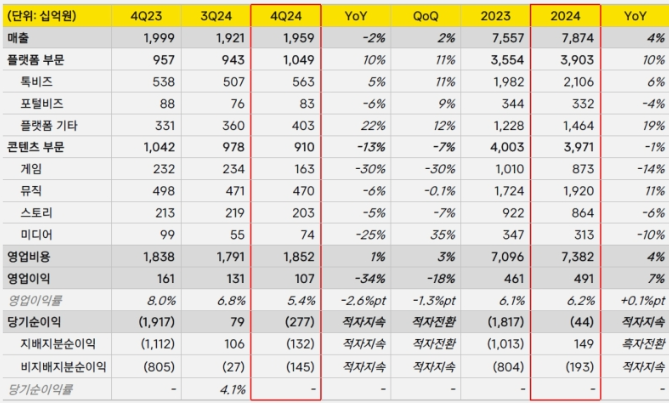

However, Kakao’s 2024 annual financial statements, released on the 13th, indicate a crisis. The company’s consolidated revenue for Q4 2024 was KRW 1.9591 trillion, marking a 2% decline compared to the same period last year. This suggests that Kakao is not only facing stagnation but also the risk of negative growth. According to CFO Shin Jong-hwan, a negative outlook for revenue and profitability is also expected in Q1 2025.

“Traditionally, the stable revenue from the content segment has offset the seasonal downturn of the platform business in Q1. However, in Q1 this year, the seasonal slowdown in the platform business coincides with the lowest point of the content segment’s IP (Intellectual Property) release cycle, which is expected to negatively impact consolidated revenue. Considering the fixed costs that have steadily increased across the group, profitability in Q1 is expected to face significant pressure.” — Shin Jong-hwan, Kakao CFO

The biggest factor behind Kakao’s disappointing performance in Q4 2024 was the 13% year-over-year revenue decline in the content segment (games, media, story, and music). Revenue contraction was observed across all areas of content. Additionally, although relatively smaller in scale, the portal business (Daum) within the platform segment also saw a 6% decline in revenue compared to the previous year, further negatively impacting the company’s performance.

In this context, the term ‘priority’ becomes evident in Kakao’s financial statements. The platform (other) segment, which includes mobility and payment businesses, recorded a strong 22% year-over-year growth in Q4 2024.

Kakao attributes this growth to the expansion of taxi supply and the enhancement of dispatch technology, which helped maintain a high ride success rate and maximize peak-season effects. Additionally, solid growth was recorded in quick delivery, valet, and parking services. Notably, the company refrained from making further comments on mobility during its earnings report, likely because mobility remains a business at the core of Kakao’s ‘coexistence’ strategy.

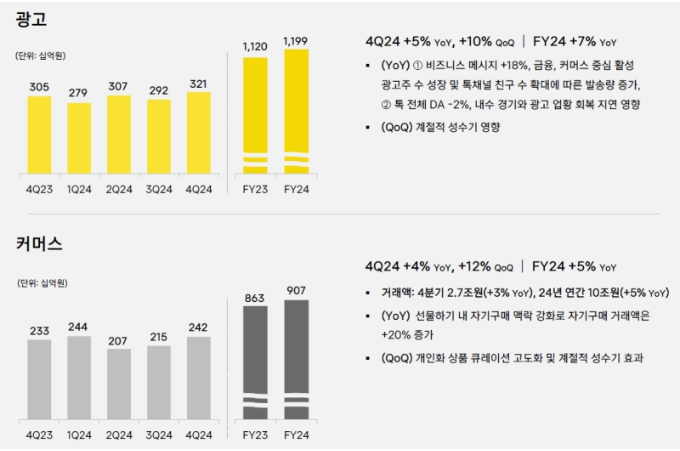

However, the true ‘core business’ that Kakao emphasized is Talk Biz. In Q4 2024, Talk Biz revenue reached KRW 562.7 billion, reflecting a 5% increase year-over-year and an 11% rise quarter-over-quarter. According to Kakao, last year, the Talk Biz advertising and commerce businesses alone achieved a high operating profit margin of 30%, demonstrating their strong contribution to overall performance.

Nevertheless, Kakao’s Talk Biz revenue growth rate may seem modest compared to competitor Naver’s recent Q4 revenue growth of 13.7% year-over-year. In response, Kakao aims to find new growth momentum through AI technology, particularly with the AI Mate service ‘Kana,’ scheduled for release in the first half of this year.

“Kakao has built business models such as business messages and gifting based on the unique ability to connect relationships. However, the pace of growth has gradually slowed. This is due to the inherent limitations of KakaoTalk’s traffic, which is primarily focused on chat, restricting user engagement and limiting new business opportunities. This year, Kakao must undergo structural changes and turn the current crisis and evolving environment into a growth opportunity. To achieve this, we will introduce new AI-driven features and services while creating new spaces where users can explore content based on their interests. By expanding from purpose-driven traffic centered on chat to new contextual traffic, we aim to significantly enhance user engagement.”— Jeong Shin-a, Kakao CEO

“We expect the weak Q1 performance to be temporary. From Q2 onwards, the core revenue drivers of Talk Biz, business messages, and gifting will continue their steady growth, while the advertising business will benefit from a favorable seasonal recovery. Additionally, various businesses within the platform segment will enter their peak seasons compared to Q1, leading to a sharp profitability recovery.”— Shin Jong-hwan, Kakao CFO

What Kakao Wants to Achieve with OpenAI

Recently, Kakao announced a partnership plan with OpenAI, drawing significant attention. Moving forward, Kakao will focus on Small Language Models (SLM) rather than developing its own Large Language Models (LLM). The company emphasizes a ‘Model Orchestration’ strategy, which involves combining cost-effective external AI models. The partnership with OpenAI will not only integrate OpenAI’s technology into Kakao’s model orchestration but also include joint service development.

During the earnings call, CEO Jeong Shin-a mentioned plans for co-developing services with OpenAI. Kakao aims to generate synergy by combining its services—such as messaging, commerce, mobility, content, and finance—with OpenAI’s AI models and machine learning algorithms.

According to Jeong, both companies will focus on enhancing user engagement and experience by developing an ‘AI Agent’ that spans the Kakao ecosystem. She stated that “the collaboration is still in its early stages, and additional discussions are needed before revealing specific details,”but emphasized that “the AI Agent will go beyond simple Q&A functions and perform complex, highly personalized tasks across various Kakao services through function calls.”

Apart from its joint service development with OpenAI, Kakao is preparing to launch services that reinforce the concept of ‘Generative Search’ across its business ecosystem, not just within KakaoTalk. This service is similar to OpenAI’s ChatGPT, providing AI-driven summarized responses based on user queries.

“Despite Kakao’s overwhelming traffic, user search engagement remains relatively low. By integrating AI into both the existing ‘# search’ and new search services, we will create an ecosystem where users actively seek information within Kakao’s platform. This expansion beyond chat-focused traffic will also help us secure new monetization opportunities.”— Jeong Shin-a, Kakao CEO

What Happens When AI and Commerce Merge?

Additional plans were shared regarding ‘Kana,’ the upcoming AI Mate service. Kakao envisions Kana as an entry point that enhances existing services by interacting with KakaoTalk users, analyzing their requests, and providing recommendations.

In December 2024, Kakao launched ‘AI Mate Shopping’ as part of KakaoTalk’s Talk Channel and web service. This feature recommends products tailored to users’ needs, whether for personal purchase or gifting. Kakao expects AI Mate Shopping to contribute to higher conversion rates and transaction volumes within KakaoTalk’s commerce services.

Previously, Kakao strengthened personalized gifting curation and promotions using user wishlist and brand preference data. As a result, self-purchase transactions in the gifting service grew by 24% year-over-year in 2024 (20% in Q4 alone), driving overall gifting transaction growth.

In February this year, Kakao plans to enhance user accessibility by adding an AI Mate Shopping entry point within its gift-giving service. In addition to strengthening its differentiated gift lineup, which includes over 200 global high-end brands, Kakao aims to refine its personalized shopping curationto help users discover and receive optimized gift recommendations based on relational and contextual factors.

Meanwhile, outside of the gift-giving service, Kakao Talk Storehas been experiencing a decline compared to the same period the previous year. However, in November 2023, Kakao reported that Talk Store’s transaction volume rebounded for the first timein the second half of the year.

Kakao is planning a gradual revamp of the Shopping tabto help users easily discover brands and products aligned with their tastes and interests. This includes expanding video-based and interactive contentcentered around Shopping Live. Similar to its approach in the gift-giving service, Kakao aims to increase conversion rates and transaction volumein Talk Store by utilizing AI-powered "discovery commerce."

As a reference, Kakao Commerce's Q4 2024 revenuereached 241.6 billion KRW, marking a 4% increase YoYand 12% increase QoQ.The total Q4 transaction volumewas 2.7 trillion KRW, up 3% YoYand 8% QoQ.For the entire year of 2024,Kakao Commerce recorded a total transaction volume of 10.1 trillion KRW, reflecting a 5% YoY growth.

"Looking at the e-commerce market trends, online shopping transaction volume in Q4 2023grew by only 1% YoYdue to economic uncertainties and major social issues affecting consumer sentiment. On the consumer side, there is a growing polarization trend—price sensitivity for daily necessities, yet increased spending on premium goods and personal indulgences. Kakao Commerce plans to enhance both profitability and growthby responding to these shifting market conditions with optimized services, leveraging an asset-lightstrategy. We aim to achieve revenue and transaction volume growth at a level similar to last year." — Jeong Shin-a, CEO of Kakao

AI Mate Expands Beyond Commerce

Alongside AI Mate Shopping, Kakao is also preparing to launch "AI Mate Local."This service will recommend various locations based on user requests and context,and is expected to integrate with Kakao’s broader local services.Starting with commerce and local services, Kakao plans to introduce various "Vertical Mates"to strengthen AI-driven business linkages.

AI Mate Commerce and Local Services are closely connected to Kakao’s business account services,specifically "Talk Channel"and "Business Message"advertising. Brands and sellers using Kakao’s Gift and Talk Store, as well as local business owners, are all key adopters of Talk Channeland buyers of Business Message ads.

Despite an overall slump in the ad market, Kakao’s Business Message ad revenue continues to grow.As of Q4 2024, the number of users connected via Talk Channel increased by 14% YoY.During the same period, Business Message ad revenue and the number of active advertisers grew by 18% and 10%, respectively.Kakao stated that it is continuously refining its ad targeting algorithmsto better match advertisers with their preferred audience.

In contrast, display ad revenue, led by Kakao’s flagship "Biz Board," declined by 2% YoY in Q4 2024.This ongoing stagnationsuggests a structural challenge rather than a temporary trend. Kakao believes that expanding KakaoTalk traffic into “discovery-based content”could provide a turnaround opportunity for its display ad business.

In response, Kakao has announced plans to launch a "Discovery Zone" within KakaoTalk, where users will receive personalized recommendationsfor images, videos, and short-form content in a feed format.Initially, the content will be provided by professional content creators, but over time, AI-generated content and user-generated content (UGC)will be incorporated.

"While various social media platforms already exist, the way KakaoTalk users share their social identitywill differentiate the Discovery Zone from existing platforms. For example, on KakaoTalk, people frequently share small everyday moments,and even professional content can be integrated into casual daily contexts. Beyond just a feed-based service, we are planning additional features that will encourage continuous discovery and exploration.While it’s too early to reveal specific details, the overarching vision is to create a new space within KakaoTalk where users can explore content and entertainment tailored to their interests." — Jeong Shin-a, CEO of Kakao

Alongside the Discovery Zone launch, Kakao is preparing new display ad formats of various sizes and layouts.Previously, KakaoTalk’s revenue potential was limited as it primarily served as a messaging app.However, with the addition of "discovery-based content" placements,new monetizable trafficwill emerge. Kakao sees this as an opportunity to reignite growth in display ad revenue,which has stagnated since the launch of Biz Board.

"Moving forward, we will introduce AI-powered search ads, AI-generated content-based contextual ads, and commerce ads.These innovations will allow Kakao to explore new business areas that were previously challenging. We expect double-digit growthin Talk Biz ad revenue in the second half of the year, surpassing the overall online ad market growth rate of 5.1%." — Jeong Shin-a, CEO of Kakao

In summary, Kakao, like its biggest competitor Naver, is making AI the cornerstone of its service strategy.The overarching goal of using AI to recommend content and productsis similar for both companies. However, Kakao's distinct advantagelies in its dominance as Korea’s No.1 messaging app, KakaoTalk.

As AI integration creates new commerce and ad opportunities,brands and sellers should closely monitor these developments and adapt their strategies accordingly.

Contact us and we'll help you learn more and connect your business. cs@beyondx.ai