From Return Pickup to Quality Restoration and Resale: Creating a Service for Under 2000 Won per Item?

From the Editor-in-Chief

According to a report by digital market research firm eMarketer, the e-commerce return rate is expected to reach around 20% in 2022, more than double the return rate for brick-and-mortar stores. In the fashion category in particular, the return rate can reach 40% per month, and this trend, coupled with the growth of the e-commerce market, is leading to an increase in the volume of returns. However, there are few companies that specialize in providing affordable logistics services for returns, and we'd like to take a look at the background and solution.

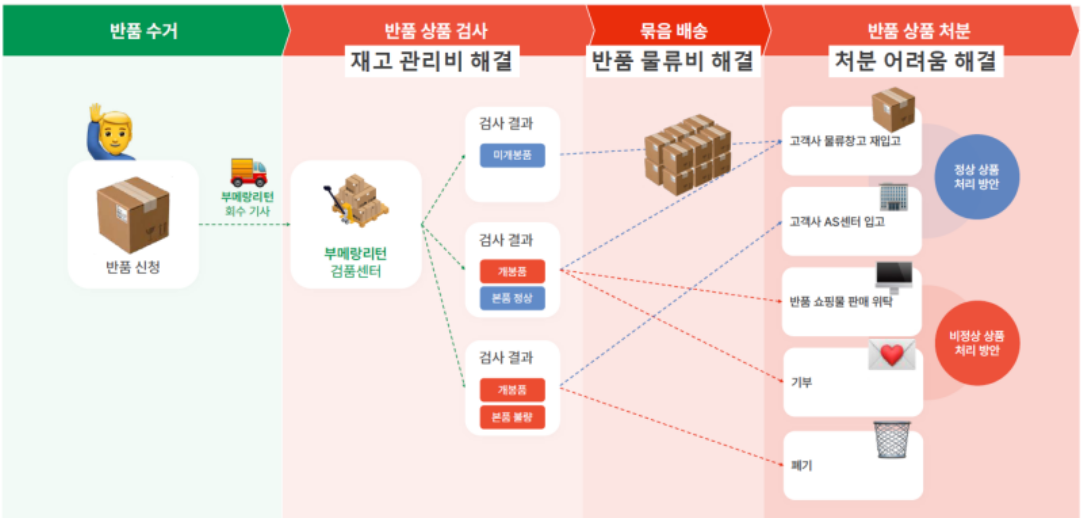

Returnall, which operates the return logistics service 'Boomerang Return', offers a solution that provides a one-stop solution from return collection to inspection, merchandising, restocking, or disposal. The service offers basic collection and restocking for up to 2,000 won per case, while the service that includes inspection and grooming costs an average of 2,850 won per case. This seems like a great deal compared to the cost of return couriers in the current market.

One of Boomerang Return's strengths is its speed in inspecting returns. Dae-gun Yoon, the CEO of Boomerang Returns, has built an automated return inspection system based on his unique background, which gives the company a competitive edge. Boomerang Returns also offers a service to "dispose" of troublesome returns, which is very popular with shipper customers.

BoomerangReturn's ultimate goal is to expand its solution business to the global market. Currently, returns are inspected and merchandised at BoomerangReturn's warehouses, but the company is in the process of enhancing its solution capabilities so that it can be embedded with e-commerce platforms, manufacturing brands, and fulfillment companies. This strategy, which also includes developing international sales for returns, will play an important role in realizing Ritternoll's short-, medium-, and long-term goals.

This article details the current state of returns logistics, the innovative solutions offered by Returnol, and how the industry is changing and what the future holds.

CHAPTER 1

Can Services Like Coupang's Return Market be Outsourced?

In the past few years, the e-commerce market has grown rapidly, along with the increase in returns. According to global e-commerce solution Shopify, the return rate in e-commerce varies by category but ranges from 20 to 30%. eMarketer reports that in 2022, the e-commerce return rate was about 20%, more than double that of offline returns.

An episode comes to mind. About four years ago, I heard from a logistics manager of a global fast fashion brand about the headaches caused by 'returns'. After initiating a free online return service, customers started ordering without much consideration for size, color, material, or fit. They would try on the delivered clothes, keep the ones they liked, and return the rest. Naturally, this increased the labor and cost associated with return logistics, and the policy was short-lived.

Similar cases are easy to find in other domestic companies. 11th Street once introduced '11th Street Return Insurance' in February 2020 to support return shipping costs for simple customer changes of mind but has since ended the service. SSG.com launched a policy in May 2021 to refund return shipping costs up to 10 times a month in SSG Money, but it did not last long. Fashion vertical platform Zigzag also introduced a free return service for products from its fulfillment direct delivery merchants in May 2021, but it has since disappeared.

Not all companies' free return policies have failed, however. Coupang's paid membership 'Rocket Wow' has offered unlimited free return services to its members since its launch. Rocket Wow has become a representative business model that Chairman Kim Beom-seok emphasizes as driving Coupang's growth and profitability. Particularly, Rocket Wow members, who consistently purchase from Coupang, facilitate relatively smooth return pick-ups. Based on this, Coupang launched the 'Return Market' in March last year, and within three months, its user base increased by 35%.

Many companies have attempted free return services, believing they enhance customer service and positively impact purchase metrics. However, they ultimately discontinued the service due to the logistics cost and labor involved in collecting returns and the lack of viable methods for reselling the products.

What if a company could handle return pickups for less than the 2000 won charged by courier services? For 2850 won, if the company could undertake inspection and quality restoration of collected returns, and potentially even facilitate reselling the restored products? Could services like Coupang's Return Market operate on an outsourcing model?

Connectorus met with such a company. 'Returnall,' a startup specializing in return logistics now in its fourth month, claims to have found a solution to the high costs of return logistics, a prominent issue in the domestic return market. They have developed an integrated return logistics solution 'Boomerang Return,' connecting quality restoration to add value. We met with CEO Yoon Daegun of returnall to learn more about their methods.

CHAPTER 2

The Challenges of Return Logistics

Domestic e-commerce returns are primarily based on courier services. Customers who wish to return or exchange products pay the return logistics fee set by the e-commerce company to request collection. The seller is responsible for inspecting the collected goods and preparing them for resale through quality restoration.

According to a current e-commerce seller, handling return logistics, whether done personally or outsourced, is always challenging. "Return rates for clothing are quite high, often exceeding 20%, and in some months, they can even reach 30 to 40%. The difficulty with returns lies in the time and cost involved," says the seller.

Firstly, it takes a while for return volumes to get back to the logistics center. While forward shipping can be completed in a day or two, return reverse shipping typically takes 5-7 days. If the courier is busy and overlooks a pick-up, it can take even longer.

Each returned item requires inspection. The first check is for contamination, damage, or deformation. Also, whether the return reason stated by the customer matches, if the number of items is correct, and whether a different size or color product was included, must be meticulously verified. With a high volume of returns, it is crucial to reprocess as many as possible to minimize losses. It is also necessary to reconcile the inventory in the system with that in the logistics center. Even small discrepancies in returns can lead to significant issues later on.

Completing the process to prepare a returned product for resale takes at least two weeks. As sales increase, so do returns, eventually turning a corner of the logistics center into a space exclusively for returned goods. Disposing of these in bulk is difficult as valuing them is not straightforward. While entrusting a fulfillment company is an option, there is unease in relying on their thoroughness in inspection and quality restoration, and the additional cost is also a burden," said Seller A from a clothing store on Naver SmartStore.

Yoon Daegun, CEO of returnall, has also experienced these difficulties in the return process. Before founding the company, he had extensive experience in various roles, including marketing, product planning, and e-commerce logistics in multiple brands. He noticed that return reverse logistics was particularly inefficient compared to forward logistics. Meeting various sellers, he focused on the challenges of return logistics and began seeking solutions.

According to Yoon, the first weakness of return logistics is the lack of volume discounts, unlike forward logistics. While forward logistics involves collecting large volumes of goods from a seller's logistics hub to distribute to multiple customers, return logistics involves collecting small quantities of goods from various customers' homes. With scattered collection points and small volumes at each, it's challenging to achieve economies of scale, resulting in higher costs than forward logistics.

Yoon also notes that inspection and quality restoration after collection are not easy tasks for sellers. Doing it themselves is time-consuming and burdensome, and outsourcing to a third-party logistics provider can lead to less thorough inspection and restoration if the logistics center staff are not familiar with the products. Moreover, the additional logistics costs for shipping quality-restored products back to the seller cannot be ignored.

urthermore, disposing of the majority of return volumes that do not meet quality restoration standards is very problematic. Even liquidators are reluctant to take defective return goods. Donating requires meeting certain standards, and disposal incurs costs. Just as unsold new goods are challenging to manage, returned goods pose even more significant issues.

CHAPTER 3

Opportunities for Cost Reduction Amid Challenges

Despite these difficulties, Yoon saw opportunities within the challenges of return logistics. He summarized the characteristics of return logistics as '3 No's': no need for a cold chain, quick collection, or nationwide delivery. Leveraging these characteristics could potentially reduce the essential infrastructure costs of logistics operations.

"Firstly, there is no need for a cold chain in return logistics. For fresh food, most returns are disposed of by the buyer, even if a return request is made. This is why there is no return logistics in food commerce platforms, even though they manage misdeliveries and return figures. If a collection is conducted, it is done with commercial vehicles, not refrigerated trucks, and the items are processed for disposal.

Secondly, quick collection is not necessary for return logistics. While consumers are very sensitive to the speed of receiving products, they are relatively indifferent to the speed of return pick-ups. As long as refunds are processed promptly, they do not pay much attention to when the return box at their doorstep is collected.

Lastly, nationwide delivery is not necessary for return logistics. While collection points can be nationwide, the final destinations for return volumes are almost exclusively logistics centers near Gyeonggi Province. Using these three characteristics well can create efficiency unique to return logistics," said Yoon Daegun, CEO of returnall.

Boomerang Return has built its infrastructure for return logistics considering these three characteristics. First, Boomerang Return operates dedicated return collection drivers. Through API integration, they provide return collection services throughout Seoul based on return request information received from client companies. If the number of return volumes increases beyond the capacity of the collection drivers, rented vehicles are used in parallel.

As Yoon mentioned, quick collection is not essential for return logistics. Therefore, Boomerang Return operates its service based on collecting within three days of a return request. This approach allows maximizing the collection volume per driver, enabling relaxed and cost-efficient scheduling.

Additionally, Boomerang Return plans to expand its direct collection range from Seoul to the entire Gyeonggi Province within the first half of the year. The company is not considering national expansion, as e-commerce volumes outside the metropolitan area are insufficient to create a dense return volume, and traditional courier-based return collection is viable. The strategy focuses on efficiency in Seoul and the surrounding metropolitan area.

Boomerang Return's infrastructure is not limited to transportation for collection. It also operates its logistics center in Gunpo, Gyeonggi Province, for return inspection. The fact that the majority of customer logistics centers, the final destinations for return logistics, are located in the Gyeonggi Province region, significantly contributed to cost reduction. Boomerang Return loads inspected and repackaged return volumes onto pallets and delivers them in a milk run operation to various logistics centers of client companies in the outskirts of Gyeonggi Province. This approach further reduces the per-item cost of return volumes.

Moreover, Boomerang Return utilizes a space built for factory use, not as a warehouse, for its logistics center. While typical logistics centers prefer first-floor locations with high ceilings and truck docking facilities for inventory storage, Boomerang Return prioritizes rapid inspection and quality restoration, followed by freight transportation to customer logistics hubs. Therefore, a large space for long-term inventory storage is unnecessary. For this reason, the Boomerang Return logistics center is located on the second floor with a freight elevator. This results in relatively lower rent and advantages in equipment management.

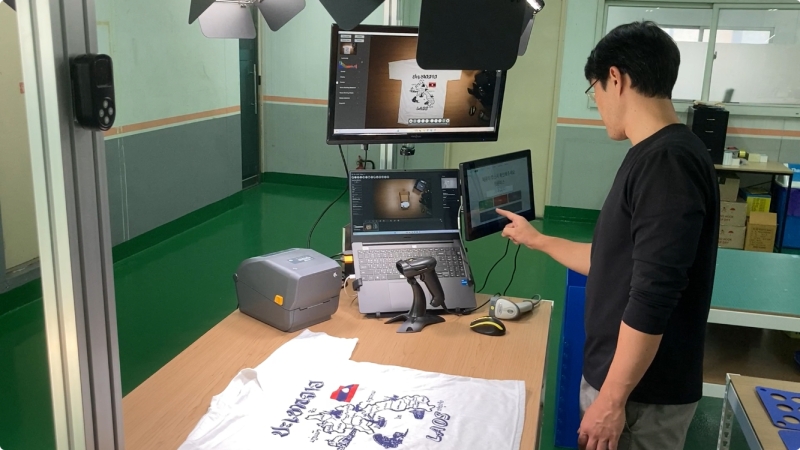

Particularly, the most significant factor in cost reduction for Boomerang Return has been the technology for inspection. Yoon, with his prior experience in brand product planning, paid special attention to D/W (Dimension/Weight) measuring equipment used in factories for product inspection. He was confident that adapting this equipment for return inspection would allow automation at an efficient cost.

"We thought that purchasing cameras, weight measuring devices, and vision recognition solutions separately and combining them would not be cost-competitive. Instead, we considered using factory inspection equipment, which is already a finished product with operating software, for logistics purposes. Adapting mass-produced equipment is much cheaper.

The result was successful, and the inspection speed improved to 1/30 of the time compared to the original manpower, both faster and more accurate. What used to take a skilled inspection worker 30 minutes to process, comparing with order information, is now completed by one inspection device and one person in one minute.

This aspect significantly reduced the per-item service cost of Boomerang Return. Besides, we are actively utilizing the unique characteristics of return logistics for cost reduction," said Yoon Daegun, CEO of returnall.

Consequently, returnall's one-stop return logistics solution 'Boomerang Return' was able to set the cost of return logistics in the 2000 won range per item. If the client company wishes only for return pickup and shipping, the service is provided for a maximum of 2000 won per item. If the process includes inspection and quality restoration, it is available for an average of 2850 won per item.

CHAPTER 4

Value Chain Post-Collection and Inspection

So far, we've explored the operational methods and cost-saving secrets of the Boomerang Return solution. According to CEO Yoon, while the low cost and accurate inspection of Boomerang Return are certainly key competitive strengths, there's another area that garners significant interest and satisfaction from clients: the disposal of return volumes.

"Typically, returned goods are restocked at the client's logistics center, or if issues are found during inspection, they are sent to the client's service center. Boomerang Return goes a step further by offering three additional options. The first is consignment sales for the return mall. Returnall takes charge of consignment sales for reconditioned stock, earning a portion of the sales revenue as a fee.

Next is donation. Returnall has partnerships with donation organizations and is operationally linked with their logistics centers. If a client wishes, we can directly donate the reconditioned goods and even link this to tax benefits.

Lastly, we offer disposal. Disposing of goods incurs costs, varying by weight, volume, and material. By consolidating and disposing of large volumes at once, we achieve cost savings," explains Yoon Dae-gun, CEO of Returnall.

For sellers, reselling difficult return volumes has always been a headache. Ideally, rather than spending money on disposal, they'd prefer to resell through any channel to extract at least some value. However, for sellers or brands to personally explore return malls, seek out donation centers, and meet each entity's reconditioning criteria is quite cumbersome.

Especially with donations, there's a risk of doing good but receiving criticism, as Yoon explains. Donation centers, overwhelmed by indiscriminate low-quality or defective product donations, often reject return volumes or demand return of items that don't meet standards. Boomerang Return, meeting the inspection and reconditioning requirements of partnered organizations while guaranteeing tax benefits, has been welcomed by both clients and donation centers.

CHAPTER 5

Can the Solution Business Expand?

Returnall successfully generated sales of 10 million KRW in its first month of operation. While not a large sum, the company quickly gauged market response and willingness to pay. Based on this, Returnall aims to achieve 1 billion KRW in sales this year.

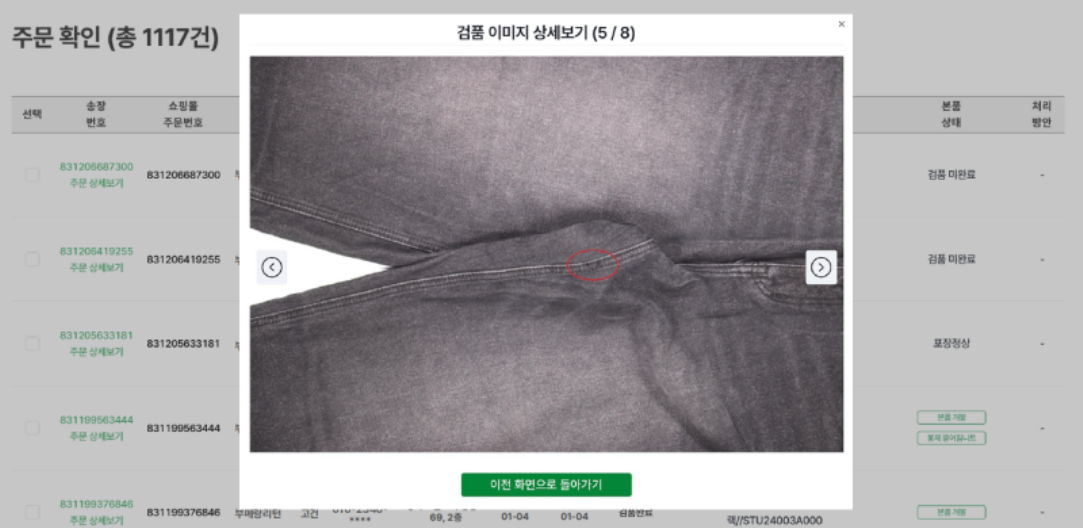

There are two main areas Returnall is focusing on. First is technology. CEO Yoon reveals plans to soon implement AI vision recognition technology into the Boomerang Return solution, enabling rapid assessment of packaging damage in returned goods. This will quickly verify if a product has been opened, enhancing overall inspection speed. As AI continues to learn from repeated images of return volumes, both speed and accuracy are expected to improve.

The second focus is on creating additional value through strengthening global distribution channels. Returnall is preparing to tap into international markets for domestic return volumes. With the global wave of Hallyu, demand for Korean brands has surged, especially in overseas markets where Korean fashion brands, which constitute a significant portion of Boomerang Return's clientele, are highly popular. For instance, simply being a 'Musinsa-listed brand' can rapidly deplete stocks in certain overseas markets.

In reality, some companies may not want return volumes, which are sold at lower prices as finished goods, appearing in markets. What if Boomerang Return could carve out overseas channels for these brands, breathing life into out-of-season stocks? This could create a win-win situation for both fashion brands and Boomerang Return.

As Yoon states, Returnall's ultimate goal is to continually strengthen its own return logistics capabilities. With these capabilities, the company plans to supply return logistics solutions to domestic and international ecommerce platforms, retail brands, and related fulfillment companies. If necessary for a client, Returnall aims to internalize the inspection process for return volumes, enabling versatile application of its solutions. The company also plans to offer services linked to the most challenging task of disposal. Will Returnall's innovative return logistics solution be chosen by the market? The future is certainly promising.

Written by Shin seungyoon. He is currently working as an e-commerce logistics specialist journalist at BEYONDX(CONNECTUS).

Contact us and we'll help you learn more and connect your business. cs@beyondx.ai